The One Big Beautiful Bill Act (OBBBA) temporarily reworks the federal deduction for state and local taxes, commonly called SALT. As you evaluate SALT deduction changes, the new limits could lower your federal income tax liability, although the rules include phaseouts and timing nuances that call for careful planning.

Quick refresher: what counts as SALT?

SALT generally covers:

- Property taxes, including on homes, vehicles, and boats.

- Investment property taxes.

- Either state and local income tax, or general sales tax, not both.

If you choose sales tax, the IRS Sales Tax Deduction Calculator can estimate your deduction and lets you add tax paid on large purchases, such as a vehicle.

Not long ago, itemizers could generally deduct all eligible SALT. The Tax Cuts and Jobs Act (TCJA) changed that starting in 2018 by capping the SALT deduction at $10,000 for most filers, with an expiration scheduled after 2025. Investment property taxes are not subject to the $10,000 limitation.

What the OBBBA changes

Rather than letting the TCJA cap lapse or become permanent, Congress set a temporary higher cap:

- Beginning in 2025, the SALT deduction limit rises to $40,000 for most filers ($20,000 for married filing separately).

- The limit increases by 1% per year through 2029.

- In 2030, the cap returns to $10,000.

There is a phaseout for high income earners. While the higher cap applies, the allowable deduction is reduced by 30% of the amount that modified adjusted gross income (MAGI) exceeds a threshold; however, the deduction cannot be reduced below $10,000. For 2025, the threshold is $500,000. Once MAGI hits $600,000, the deduction is effectively back to the $10,000 cap. Thresholds are halved for separate filers and rise 1% annually through 2029.

A simple savings illustration

- A single filer in the 35% bracket with $40,000 of SALT and MAGI below the threshold would save $10,500 in federal tax compared with a $10,000 cap, because 35% × ($40,000 − $10,000) = $10,500.

If your income exceeds the threshold

- Suppose MAGI is $560,000 in 2025, which is $60,000 above the threshold. The $40,000 cap is reduced by 30% × $60,000 = $18,000, leaving a maximum SALT deduction of $22,000. That is still more than double the $10,000 cap.

Itemize or take the standard deduction?

You only benefit from SALT if you itemize. Under the OBBBA, the 2025 standard deduction is:

- $15,750 for single and separate filers,

- $23,625 for heads of household,

- $31,500 for joint filers.

If your SALT plus other itemized deductions, such as mortgage interest, charitable gifts, and eligible medical expenses, exceed your standard deduction, itemizing can reduce your tax bill. The new, higher SALT deduction cap may push more taxpayers back into itemizing.

Watch the “SALT torpedo” effect

For MAGI between $500,000 and $600,000, the phaseout can make each additional dollar of income more costly, since you add income and lose part of the SALT deduction at the same time.

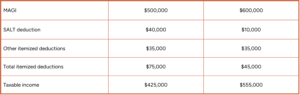

Example assumptions: MAGI increases from $500,000 to $600,000, SALT expenses are $40,000, and other itemized deductions are $35,000.

That $100,000 income increase causes $130,000 more taxable income because of the lost SALT deduction. At a 35% marginal rate, that is $45,500 of additional tax, which produces an effective rate of 45.5% on that income band. Even at $600,000 MAGI, itemizing still helps in this example. If your remaining itemized deductions, including the reduced SALT amount, fall below your standard deduction, the standard deduction would be the better choice.

Planning moves to consider

Your MAGI is the lever that determines whether the phaseout hits you, and by how much. Depending on your situation, consider:

Ways to reduce MAGI

- Increase pre-tax 401(k) and Health Savings Account contributions, up to annual limits.

- If self-employed, use a retirement plan that allows larger contributions than an employee plan.

- Evaluate the timing of bonuses, deferred compensation, or equity compensation exercises.

Moves that can raise MAGI

- Roth conversions, optional traditional retirement distributions, and large capital gains from asset sales.

- Mutual fund distributions late in the year. Exchange-traded funds may provide more control over taxable distributions.

Timing SALT payments

- Since the higher cap is temporary, you may want to capture as much SALT as allowed each year it is available. For example, if your MAGI is below the threshold and your SALT is under $40,000 for 2025, you might prepay 2026 property taxes in 2025 if your jurisdiction has assessed the amount. Prepayment based only on an estimate does not qualify.

PTET elections, and why they still matter

After the TCJA’s $10,000 cap, 36 states enacted pass-through entity tax (PTET) regimes. These often allow state income tax to be paid at the passthrough entity level, which is deductible without the SALT cap, instead of at the owner level, which is capped.

The OBBBA keeps PTET workarounds in play, and elections may still provide value. For instance, an entity-level payment can reduce an owner’s share of self-employment income or allow the owner to take the standard deduction. Note that some state PTET provisions were scheduled to expire after 2025 when the TCJA cap was expected to sunset. Legislatures may renew, revise, or let them lapse, so entity owners should revisit the analysis each year.

SALT and the alternative minimum tax

SALT is not deductible for AMT purposes. A large SALT deduction could push more income into the AMT calculation, particularly after 2025. Taxpayers must compute both regular and AMT liability and pay the higher amount. AMT starts with regular taxable income, then adds back various preference items, including SALT.

For 2025:

- The AMT exemption is $88,100 for singles and heads of household, with a phaseout beginning at $626,350 of AMT income.

- For joint filers, the exemption is $137,000, with a phaseout beginning at $1,252,700.

The OBBBA makes these higher exemptions permanent. Beginning in 2026 for joint filers, it resets the phaseout threshold to the lower 2018 level of $1,000,000, indexed for inflation going forward, and it doubles the exemption phaseout rate. The act does not state a similar reset for other filing statuses, which may be a drafting oversight. A later technical correction could extend the reset to other filers.

Bottom line

With SALT deduction changes, the temporary SALT expansion, the income-based phaseout, and the AMT interaction create new planning windows, as well as new pitfalls. Reviewing MAGI management, itemizing versus standard deduction choices, PTET elections, and payment timing can help you capture benefits while avoiding surprises. Have questions? Contact us.