The general timing strategy to reduce taxes would be to defer income into 2025 and accelerate deductible expenses into 2024, assuming you won’t be in a higher tax bracket next year. (If you’ll likely be in a higher tax bracket in the near future, you may want to flip the general strategy.)

In recent years, this strategy has also been impacted by the possibility of increased tax rates due to future legislation while also considering the impact of inflation on future tax brackets. The IRS has recently issued its 2025 inflation adjusted numbers. Inflation has moderated somewhat this year over last, so many amounts will increase over 2024 but not as much as in the previous year. Take these 2025 numbers into account as you implement 2024 year-end tax planning strategies.

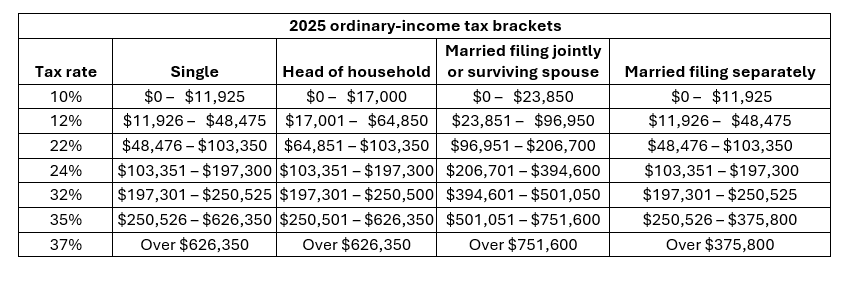

Individual income tax rates

Note that under the TCJA, the rates and brackets are scheduled to return to their pre-TCJA levels (adjusted for inflation) in 2026 if Congress doesn’t extend the current levels or make other changes. The highest ordinary income tax bracket pre-TCJA was 39.6% instead of the current 37%.

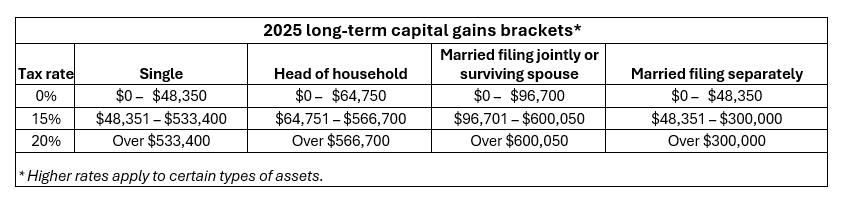

Long-term capital gains rate

The long-term gains rate applies to realized gains on investments held for more than 12 months. For most types of assets, the rate is 0%, 15% or 20%, depending on your income level. While the 0% rate applies to most income that would be taxed at 12% or less based on the taxpayer’s ordinary-income rate, the top long-term gains rate of 20% kicks in before the top ordinary-income rate does.

As with ordinary income tax rates and brackets, those for long-term capital gains are scheduled to return to their pre-TCJA levels (adjusted for inflation) in 2026 if Congress doesn’t extend the current levels or make other changes.

Itemized Deductions

Due to several related provisions in the TCJA, generally effective through 2025, more individuals claim the standard deduction in lieu of itemizing deductions. It has also increased the importance of planning the timing of certain itemized deductions for some taxpayers.

For instance, you may want to “bunch” charitable donations in a year you expect to itemize deductions. (There is more on charitable deductions below.) Similarly, you might adjust the timing of certain medical expenditures to provide the maximum medical deduction. The deduction for those expenses is limited to the excess above 7.5% of your adjusted gross income (AGI). If it is not likely that you will be deducting medical and dental expenses in 2024, you might choose to postpone non-emergency expenses to 2025.

Note that the TCJA made other significant changes to itemized deductions. This includes a $10,000 annual cap on deductions for state and local tax (SALT) payments through 2025.

Tip: The standard deduction for 2024 is generally $14,600 for single filers and $29,200 for joint filers and will be $15,000 and $30,000, respectively, in 2025. (an additional amount is allowed for taxpayers age 65 or older.)

YEAR-END MOVE: If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2024. For example, consider the following possibilities.

- Donate cash or property to a qualified charitable organization (see more below).

- Pay deductible mortgage interest if it otherwise makes sense for your situation. Currently, this includes interest on acquisition debt of up to $750,000 for your principal residence and one other home.

- Make state and local tax (SALT) payments up to the annual SALT deduction limit of $10,000.

- Add home improvements that qualify for mortgage interest deductions as acquisition debt. This includes loans made to substantially improve a qualified residence. Note that interest on a home equity line of credit (HELOC) or a home equity loan is only tax deductible if the funds are used to buy, build or improve your residence.

- Schedule non-emergency physician or dentist visits in 2024 if you expect to qualify for a medical deduction this year. Only unreimbursed expenses above 7.5% of your adjusted gross income (AGI) are deductible.

Charitable Donations

The tax law allows you to deduct charitable donations within generous limits if you meet certain recordkeeping requirements.

YEAR-END MOVE: Step up charitable gift-giving before January 1. As long as you make a donation in 2024, it is deductible in 2024, even if you charge it in 2024 and pay it in 2025.

- If you make monetary contributions, your deduction is limited to 60% of your AGI. Any excess above the 60%-of-AGI limit may be carried over for up to five years.

- If you donate appreciated property held longer than one year (i.e., it would qualify for long-term capital gain treatment if sold), you can generally deduct an amount equal to the property’s fair market value (FMV) on the donation date, up to 30% of your AGI. Donating appreciated assets can be especially lucrative since you avoid capital gains tax and, if applicable, the net investment income tax (NIIT) on the appreciation. But the deduction for short-term capital gain property is limited to your initial cost.

- Consider a qualified charitable distribution (QCD). If you are age 70½ or older, you can transfer up to $105,000 of IRA funds (adjusted annually for inflation) directly to a qualified charity. Also, if over age 73, it counts as an RMD. This doesn’t qualify for the charitable contribution deduction, but it’s not taxable so may be beneficial for taxpayers who do not itemize or who have deductions subject to AGI limitations since a QCD is not included in AGI. In addition, SECURE 2.0 authorizes a one-time transfer of up to $53,000 to a charitable remainder trust (CRT) or charitable gift annuity (CGA) as part of a QCD.

- Donor Advised Funds (DAFs) may be an excellent vehicle for taxpayers desiring to “bunch” their itemized deductions (per above) or donate appreciated securities or other noncash assets, particularly if they are also seeking to obtain a charitable contribution deduction this year while deferring payment to the ultimate charitable beneficiary until a later date. Consult your tax or investment advisor for more details.

Tip: Any contributions in excess of the AGI limits may be carried over for up to five years.

Alternative Minimum Tax

The complex alternative minimum tax (AMT) calculation features several technical adjustments, inclusion of “tax preference items” and subtraction of an exemption amount (subject to a phase-out). After comparing AMT liability for the year to regular tax liability, you effectively pay the higher of the two.

YEAR-END MOVE: Have your tax professional assess your AMT status. When it makes sense, you may shift certain income items to 2025 to reduce AMT liability for 2024. For instance, you might postpone the exercise of incentive stock options (ISOs) that count as tax preference items.

Tip: The AMT rate for both single and joint filers for 2024 is 26% on AMT income up to $232,600 (or $116,300 if married and filing separately) and 28% on AMT income above this threshold. Also, the AMT exemption amount is $85,700 for single and $133,300 for joint filers, subject to phaseout.

The exemptions and phaseouts were significantly increased under the TCJA and will drop to their pre-TCJA levels (adjusted for inflation) in 2026 without Congressional action.

Note that the top AMT rate is still lower than the top ordinary income tax rate of 37%.

Electric Vehicle Credits

If you are in the market for a new vehicle, be aware of the tax benefits of purchasing a plug-in electric vehicle (EV).

Generally, the maximum credit allowed for EVs purchased in 2024 is $7,500. The vehicle must be powered by batteries with materials sourced from the U.S. or its free trade partners and it must be assembled in North America.

However, the credit cannot be claimed by a single filer with a modified adjusted gross income (MAGI) above $150,000 or MAGI of $300,000 for joint filers. Also, the credit is not available for most passenger vehicles that cost more than $55,000. The threshold is $80,000 for vans, sports utility vehicles (SUVs) and pickup trucks.

In addition, starting in 2023 the IRA authorizes a credit of up to $4,000 for used vehicles if you are a single filer with an MAGI of no more than $75,000; $150,000 for joint filers. If buying a used vehicle, it must cost $25,000 or less and be at least two years old.

Furthermore, you cannot claim any credit if you lease an EV instead of buying it. And the credit for EVs is nonrefundable, so you may want time year-end purchases accordingly.

See IRS guidance on “Credits for new clean vehicles purchased in 2023 or after” for additional details.

Higher Education Credits

The tax law provides tax breaks to parents of children in college, subject to certain limits. This often includes a choice between one of two higher education credits.

Typically, you can claim either the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), but not both. The maximum AOTC of $2,500 is available for qualified expenses for four years of study for each student, while the maximum $2,000 LLC is claimed on a per-family basis for all years of study. Thus, the AOTC is usually preferable to the LLC.

Both credits are phased out based on your MAGI. The phase-out for each credit occurs between $80,000 and $90,000 of MAGI for single filers and between $160,000 and $180,000 of MAGI for joint filers.

YEAR-END MOVE: When appropriate, pay qualified expenses for next semester by the end of this year. Generally, the costs will be eligible for a credit in 2024, even if the semester does not begin until 2025.

Tip: The list of qualified expenses includes tuition, books, fees, equipment, computers, etc., but not room and board.

Miscellaneous

- There is a new requirement in 2024 to file a beneficial ownership information (“BOI”) report for most entities, including corporations (C or S corporations), limited partnerships, and limited liability companies (LLCs). These reports are generally due no later than 12/31/2024, and possibly earlier for entities formed in 2024.

- Install energy-saving devices at home that result in either of two residential credits. For example, you may be able to claim a credit for installing solar panels. Generally, each credit equals 30% of the cost of qualified expenses, subject to certain limits.

- Avoid an estimated tax penalty by qualifying for a safe-harbor exception. Generally, a penalty will not be imposed if you pay 90% of your current year’s tax liability or 100% of your prior year’s tax liability (110% if your AGI exceeded $150,000) via withholding and/or estimated payments. The IRS considers withholding to have been withheld ratably throughout the year even if made in December.

- Pay expenses qualifying for the dependent care credit. Generally, the maximum credit is $600 for childcare costs of one under age-13-child or $1,200 for two or more qualified children.

- Empty out flexible spending accounts (FSAs) for healthcare or dependent care expenses if you will forfeit unused funds under the “use-it-or-lose it” rule. However, your employer’s plan may provide a carryover to 2024 of up to $640 of unused funds or a 2½-month grace period.

- If you own property damaged in a federal disaster area in 2024, you may qualify for faster-than-usual casualty loss relief by filing an amended 2023 return. The TCJA suspended the deduction for casualty losses for 2018 through 2025 but retained a current deduction for disaster-area losses.

We Are here to help

From charitable contributions to optimizing deductions, Maxwell Locke & Ritter is here to guide you through every step of your year-end tax planning. Contact us today if you have questions about these updates.